The goal of this article is to provide a context before diving into Vasicek model. Therefore, our goal is mainly to explain why are certain interest rates negative and to present the consequences of this phenomenon.

Negative Interest Rates: what does that mean ?

An interest rate is the cost of borrowing. Lenders charge borrowers interest when they take out any type of debt. Therefore, interest rates are ubiquitous in the economy: loans, mortgages or bonds are different examples of how they can be used.

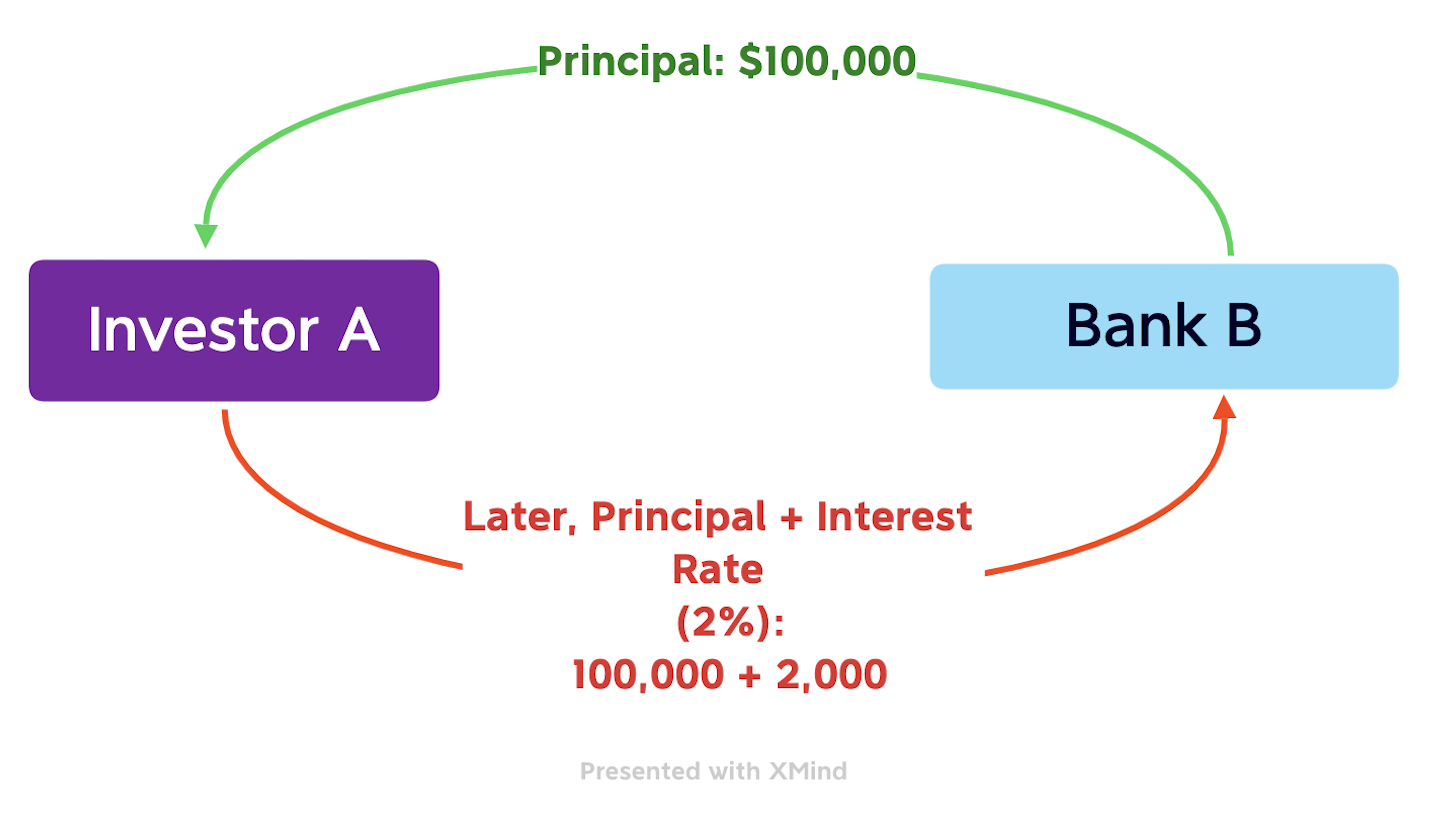

Let’s take the example of a bond. A bond represents a promise by a borrower to pay a lender their principal and usually an interest on a loan.

We consider a one-year zero-coupon bond described as followed: a bank B lends $100,000 to an investor A. In return, the investor A must pay back the principal ($100,000) plus and interest rate. Let’s say 2% which means that the investor A pays back $102,000 to the bank B.

In our example, if interest rates were negative, transactions would utterly change. In the case of intermediate payments (coupons) before maturity, the investor A would be paid for borrowing the money !

Interest rates tell how valuable money is today compared to the same amount of money in the future. Positive interest rates imply that there is a time value of money: money today is worth more than money tomorrow. Thus, a negative interest rate implies that the money now is worth less than in the future.

Role of Central Banks

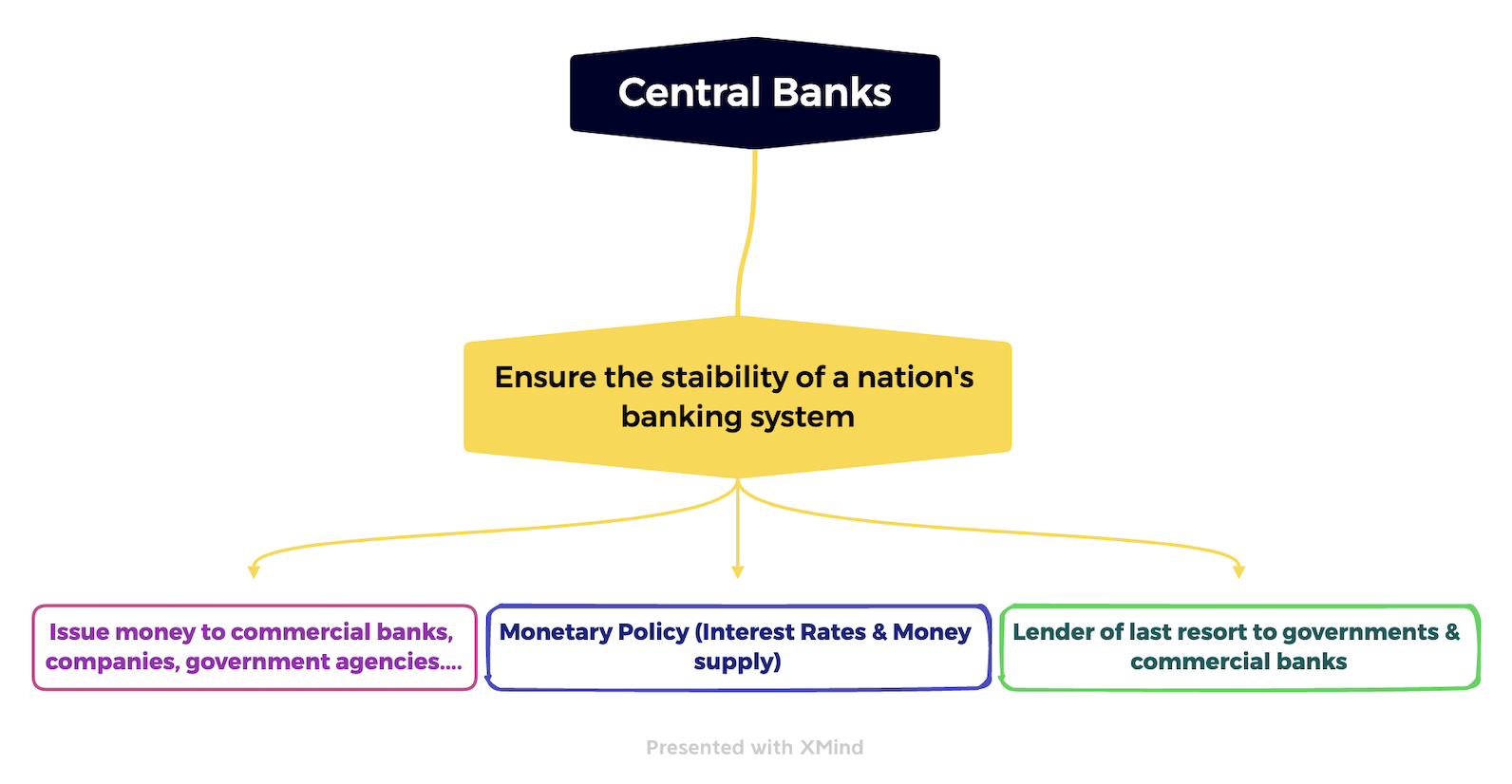

First of all, it is important to understand the role of central banks. A key role of central banks is to conduct monetary policy to achieve price stability (low and stable inflation) and to help manage economic fluctuations. Nowadays, an inflation rate of 2% over the medium term is the target that has been announced by the European Central Bank.

More details can be found here: https://www.ecb.europa.eu/mopo/decisions/html/index.en.html

Obviously, beyond this monetary policy, central banks are also lenders of last resort to governments and commercial banks. A lender of last resort is whoever you turn to when you urgently need funds and you’ve exhausted all your other options.

Central banks try to control the inflation level and to maximize the economic growth simultaneously.

We focus on this monetary policy as it is closely related with interest rates. Basically, the global economic growth has been really low over the last two decades. As a result, central banks tried to boost the economy.

First, this has been done by reducing interest rates. Indeed, reducing interest rates makes investors less mistrustful as they are more likely to be able to pay back the lenders. In other words, borrowing money costs less than usual. Then, central banks also used Quantitative easing. This means that banks purchase longer-term securities in order to increase the money supply and encourage lending and investment. It is also a way to buy a part of the government-debt.

Let’s focus on this whole process and see how we ended up with negative interest rates.

How did we end up with Negative Interest Rates ?

Well, negative interest rates are not a theoretical concept that has never been considered. First, they appeared with the CHF in Switzerland in 1971. The inflation rate was around 12% in 1973 ! Similarly, they were adopted with the JPY in the 90s during the Japan’s Banking crisis.

Overall, the purpose was to make the money less attractive in order to facilitate exports.

An excess of liquidity

Then, the different markets stumbled in the wave of the 2008 crisis. This pushed central banks to invade the markets with liquidity and QE to boost the economy. The goal was clear: encourage individuals and banks to invest in riskier assets. This has been combined with QE and it eventually worked… until the Covid crisis hit the markets. The ultimate consequence is a long-lasting inflation.

Indeed, there is not much that can be done with an excess of liquidity. For instance, central banks can reduce it by lending to other banks or by purchasing assets. Nonetheless, the liquidity always ends up in another bank.

Therefore, with negative interest rates, storing cash incurs a fee rather than earning interest. Consumers and banks have to pay interest in order to deposit money into an account.

Who benefits from Negative Interest Rates ?

With negative interest rates, commercial banks are charged interest to keep cash with a nation’s central bank, rather than receiving interest.

But this phenomenon does not apply to consumers and/or individual investors. Commercial banks are unwilling to charge them for deposit. It concerns another sphere of investors mostly banks, government agencies and governments in general.

What is currently happening ?

Negative interest rates are widely used nowadays. However, the context is changing because of inflation. Indeed, what follows a period of Quantitative easing is the phenomenon of Quantitative tightening.

It is a tool used by central banks to diminish the amount of liquidity in the economy. More specifically, the number of financial assets hold by central banks diminishes. They are sold into the financial markets. Thus, this spawns a decrease in asset prices and a raise of interest rates. Those « rate hikes » aim to slow the economy down and to decrease the high inflation level.

So, are negative interest rates that bad ? Well, it is far from being an ideal scenario as it fosters inflation. Nevertheless, for governments, this phenomenon enables them to not pay interests every time they issue a bond.

Is it a long-lasting phenomenon ? What is sure is that the lack of economic growth, especially from the Group of Seven (G7) is intertwined with the presence of negative interest rates.

What’s next ?

To put it in a nutshell, the main purpose of negative interest rates is clearly to avoid saving money and to push investors to invest. This is done when there is a need to boost the economy.

Now, our goal is to be able to model those interest rates. To do so, the focus will be made on Vasicek model. It is a model that has been frowned on for a long time as it permited rates to become negative. Given the current context provided in this article, it makes sense to learn more about it nowadays !

Credits: Photo by Maryna Yazbeck on Unsplash